Formula 1 Sovereign Markets

It is expected that President Vladimir Putin will continue his work on the political scene as constitutional changes give him several options to remain in power beyond 2024, thus no material divergence from existing fiscal policy is anticipated.

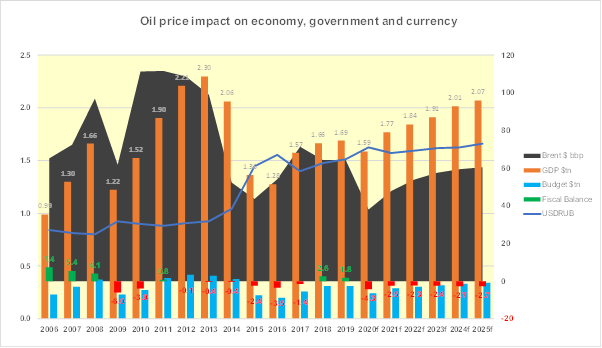

The Russian Ministry of Finance projects a budget deficit of 4.3% of GDP in 2020. This assumes a 22.5% decline in revenue in USD terms and -15% in RUB as the government expects local currency to appreciate against the dollar on the back of oil recovery, lower interest rates, overall economic recovery and the US presidential election later in the year. Expenditure is set to rise by 10%, a growth equivalent to 2009-10.

Under a more severe scenario emulating that of the 2008-09 global financial crisis, when budget revenue collapsed by 38% in dollar terms triggering the country’s first deficit since 1999 at 6% of GDP, it is likely that the equally damaging Covid-19 pandemic effect this year could push the deficit below projections but we do not anticipate for major oil producer to have more than 5% deficit.

It is widely known that oil related export revenues contribute towards one third of Russia’s GDP, two thirds of export revenue and half of the Russian government’s revenue. Between January and May 2020 Brent averaged at $40 per bbl vs. $64 per bbl in 2019, a 38% decline. Such significant weakness in oil prices occurred in the period up to May 2020 in part on the back of the involvement of the largest Russian oil producers, who were not willing to put up with losing their market share to US shale producers, and their lobbying efforts.

It may also potentially be driven as the Kremlin starts its bid to manoeuvre US leadership into a vulnerable and somewhat Russia dependant position ahead of the presidential election in November. In addition, the Russian government retaliating for harsh sanctions on its leading oil company’s Venezuelan business partially caused the collapse of so-called OPEC+ alliance temporarily, which led to unlimited production.

Brent averaged at $27 per bbl in this period, at some point notably plummeting to $18 per bbl, a level not seen since 2001. As a result, US Permian basin shale oil production activity measured via Baker Hughes rig count number fell to just 189 in June 2020 from 788 in June 2019, which will no doubt displease important donors to the Republican party as well as its Texas voters.

Covid-19 and sanctions imposed by the US, EU and Japan on certain state-owned corporates in Russia is also likely to impact the country’s sovereign fiscal balance as tax receipts will decline.

Over the next 5 years the Russian budget deficit is likely to average at -3%, a higher than previous 10-year average of -1%. The main reason is demographics and infrastructure driven expenditure growth. Outflows will remain at their long-term average rate of 6-7% per year but recovery of revenue growth will slow to 8% vs. 11% in the previous 10-year period as permanently high oil prices are unlikely to return due to efforts in implementing new ‘green’ policies and more rapid investment in alternative energy resources, which gradually will reduce the world’s reliance on petrochemicals.

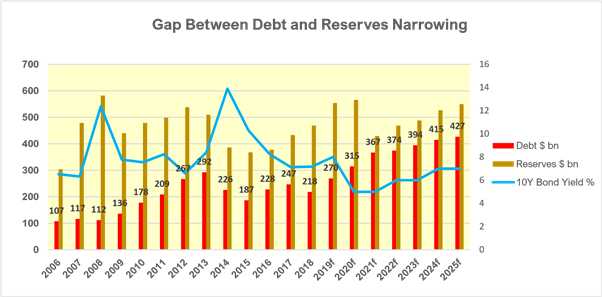

In 2020 government debt is likely to stand at $314.7bn. It is forecast to increase by 16.7% to $367.1bn in 2021 and then will steadily grow to $426.9bn in 2025. Average projected debt for the 5-year period between 2021 and 2025 will be $395.6bn, which is almost 2x of five post credit crunch years between 2010-14 level of $234.4bn. This rapid increase in leverage can be explained by inflation, increased public spending and generally larger GDP.

The government’s projections therefore can be viewed as moderately realistic if we assume a relatively fast recovery of the economy despite Covid-19, rather than a prolonged recession and slow recovery like 2010-11. For comparison, a 30.1% spike in the government’s debt was evident in 2009-10 but this was from much smaller base and as mentioned before effects of global financial crisis were more severe and prolonged. The latest projections can be considered as conservative as revenue growth is only slightly slower than after the global financial crisis of 2008-09.

Russia’s debt metrics remain very robust with total government debt vs. GDP at only 15.3% in 2019 and projected 19.6% in 2020. Even anticipated at 20.6% in 2025 by global standards is a low ratio compared to forecast 125% in the US already in 2021. This is compared to similar sized economies with a large share of commodities exports such as Brazil and Mexico whose leverage levels measured as debt/GDP are much higher at 75.8% and 46% in 2019, respectively.

Russia also maintains significant buffers in Reserve Fund and National Wealth Fund of $566bn, as well as a current account surplus of 4% which will further increase reserves, as capital outflows are moderate. Investment grade credit rating allows access to capital markets which the country has successfully done recently. It is possible that US sanctions may hit new or existing issuances, but sanctions have not historically done so in the past.

In conclusion, we believe that the government’s position is much stronger than its peer group. Market is Formula 1 friendly and able to sustain annual fee payments for the foreseeable future. Large reserves can reduce the need to tap capital markets for new sovereign bond issuances, and late backwardation in oil markets imply on price recovery in near term, which will support public finances. Russia’s 10Y bond yield is on a downwards trend approaching 5% level.